Introduction

The Bay Area Housing Finance Authority (BAHFA) has officially placed RM4 – a $20 billion 9-county regional housing bond measure – on the November 2024 ballot!

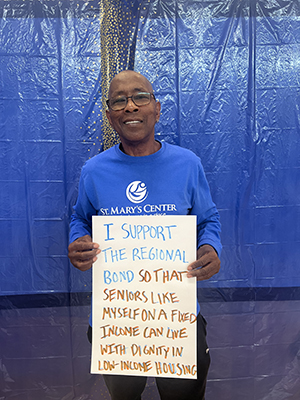

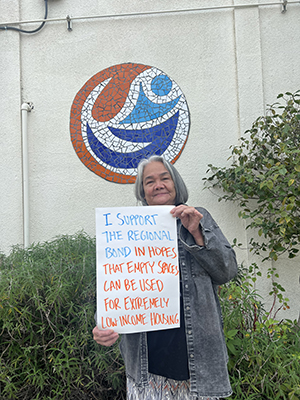

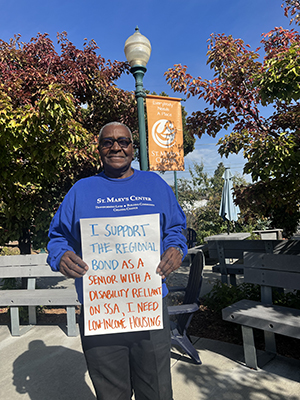

St. Mary’s Center has endorsed this initiative, as we believe it is crucial for addressing the pressing housing needs in our region, to prioritize affordable housing for extremely and very low-income residents. Join us in supporting this vital cause!

Read Our Monthly Advocacy Newsletter

July 2024 Advocacy June 2024 Advocacy May 2024 Advocacy April 2024 Advocacy

Why is a Bond Needed?

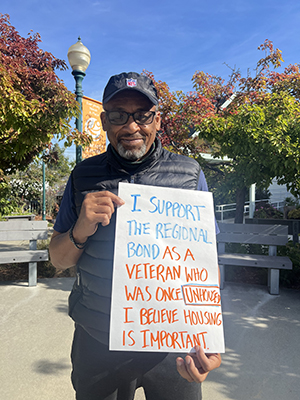

- In 2022, 37,000 people were unhoused in the Bay Area – and people over age 55 are the fastest growing unhoused demographic.

- Nearly half (45%) of Bay Area renters are rent-burdened, and 1.4 million people (23% of Bay Area renters) spend more over half of their income on rent.

- High rents and home prices force people to live far from work, making congestion and pollution much worse, and putting a major strain on working families.

- People living in overcrowded and unsafe homes.

- Vital employees and community members leaving the area entirely.

Source: MTC – Bay Area Housing Finance Authority

About the Bond

A $20 billion bond would help build and preserve approximately 72,000 affordable homes across the Bay Area – doubling the number that would be possible without a bond!

The 2024 Bay Area Regional Housing Bond aims to raise funds to:

- Increase Affordable Housing: Develop and maintain affordable housing units across the Bay Area to address the housing crisis.

- Improve Community Infrastructure: Invest in community infrastructure projects with healthier and safer living conditions to enhance the overall quality of life in the region.

- Expand Local funding: Local government bonds are one of the most powerful affordable housing financing sources available – we need a regional bond to address this regional issue.

- Enhance Accessibility: Build new homes near jobs, transit, and stores, improving convenience and reducing commutes.

- Revitalize Neighborhoods: Transform vacant lots and blighted properties into vibrant communities.

- Enable Ownership: Facilitate pathways to ownership and greater housing stability by assisting first-time homebuyers.

- Create Jobs and Boost the Economy: Generate approximately 47,000 construction jobs and another 47,000 permanent jobs.

- Leverage Additional Funding: Enable the Bay Area to qualify for an estimated $30 billion in additional state and federal matching funds.

Source: Bay Area Housing for All

Distribution of Bond Funds by County and City

Source: MTC – Bay Area Housing Finance Authority

Affordable Homes in Pre-Development

New regional resources can unlock the current pipeline of affordable homes!

Source: Enterprise and the Bay Area Housing Finance Authority

Source: Enterprise and the Bay Area Housing Finance Authority

Frequently Asked Questions

Who’s in on this effort?

Bay Area Housing for All (BAHA) is a fast-growing, large coalition in support of this measure. With 50 members, the BAHA coalition includes non-profit, philanthropic, business, and public sector partners working at the intersection of housing, racial equity, climate, transportation, and quality of life.

How will the funds from the regional housing bond be allocated?

Under state law, 80% of the funds raised through the bond will return to their county of origin (based on the jurisdiction’s share of assessed property value), and in some cases specific cities, and 20% will be administered by the Bay Area Housing Finance Authority (BAHFA) to fund critical affordable housing and services across all nine Bay Area counties

What are the accountability measures to ensure the funds are spent on our region’s most pressing needs?

Under state law, jurisdictions must submit an expenditure plan that meets the minimum allocation requirements and prioritizes housing developments that help achieve regional housing need allocation (RHNA) targets for homes affordable to extremely low income, very low income and lower income households to receive funding. If a city or county submits an expenditure plan that does not achieve those allocations and priorities, the Association of Bay Area Governments (ABAG) Executive Board and the Bay Area Housing Finance Authority (BAHFA) Board can determine that it is incomplete and withhold funds until the jurisdiction submits a complete plan.

All bond funds will be subject to independent audits, and audits and required financial reporting must be made available to the public.

Contact Us

Have questions or need more information? Contact our advocacy team:

Get Involved

Hope & Justice Organizer, Ruby Rodriguez

Email: rrodriguez@stmaryscenter.org

Policy Questions

Advocacy Manager, Courtney Welch

Email: cwelch@stmaryscenter.org

Your support is crucial in making the 2024 Bay Area Housing Regional Bond a success. Together, we can build a stronger, more inclusive, and sustainable community for all!